Top iPhone budgeting apps with real-time expense tracking to manage finances effectively.

Are you searching for the best iPhone apps to manage your finances? Whether you want to track every penny, create a detailed budget, or simply gain a better understanding of your spending, there’s an app for you. With so many options available, I’ve tested and reviewed some of the top contenders, focusing on features, ease of use, and value for money.

I also evaluated their usefulness for debt reduction, investment tracking, bill reminders, budget goal setting, and multi-currency support. Let’s dive in and find the perfect money management app for your needs.

10 Best iOS Budgeting & Expense Tracking Apps

Pros

- Effortless data entry, anytime, anywhere

- Intuitive graphical representation of spending tendencies

- Unique PC manager function for easy data management

- Accurate double-entry bookkeeping

- Versatile multi-currency support

Cons

- Feature-rich interface may overwhelm beginners

- Unlimited accounts and an ad-free experience require a subscription

“Money Manager Expense & Budget” is my go-to app for managing personal finances, as it simplifies financial tasks with customizable features and a double-entry bookkeeping system. Data entry is quick, allowing me to log expenses easily while on the move. The app visually represents my spending habits with informative graphs. The consolidated account management and multi-currency support are pretty useful, while the calendar view gives me a clear overview of my financial activities.

The app also allows me to access the PC manager function, enabling me to edit my data from my computer via Wi-Fi. Users are able to create all sorts of accounts, including tracking credit card accounts and tracking savings with recurring transactions. I appreciate its in-depth approach compared to basic budgeting apps. If you’re serious about managing your finances, I recommend giving this app a try.

Pros

- Excellent for shared budgeting between partners

- Doesn’t require linking financial accounts

- Functional free version available

- Strong visual representation of budget categories

Cons

- Manual transaction entry can be time-consuming

- Limited envelope numbers in free version

- Fewer advanced features than premium competitors

Goodbudget modernizes the classic envelope budgeting system into a money-controlling app ideal for couples or families who want to collaboratively manage money. It allows you to allocate money to virtual envelopes for different spending categories. This approach helps prevent overspending by making you conscious of your limits in each category. Unlike apps that require linking bank accounts, Goodbudget offers a manual option that appeals to privacy-conscious users or those wanting more intentional engagement with their budget.

As the name suggests, Goodbudget’s straightforward interface makes budget creation quick and intuitive. With its multi-device syncing capabilities, making it excellent for couples or families who want to share financial responsibilities. Furthermore, the envelope system provides a visual representation of your remaining funds, while the built-in reports help identify spending patterns. While the free version limits you to 10 regular and 10 annual envelopes, it’s sufficient for many users to get started. If you’re new to budgeting or prefer a more hands-on approach to tracking expenses, Goodbudget provides an accessible entry point with room to grow through its premium version.

Pros

- Proven methodology that changes financial behavior

- Excellent for couples managing finances together

- Robust educational resources and supportive community

- Exceptional customer support from real humans

Cons

- Higher price point ($99/year after free trial)

- Steeper learning curve than some competitors

- No built-in bill payment features

YNAB took my attention with its unique zero-based budgeting philosophy that assigns every dollar a specific job. Rather than simply tracking spending after the fact, I like YNAB’s proactive approach, which helps you plan your spending before it happens. The app’s four-rule methodology—give every dollar a job, embrace your true expenses, roll with the punches, and age your money—creates a framework that builds financial awareness and discipline. The interface really makes budgeting less intimidating and helps users break the paycheck-to-paycheck cycle with its forward-looking approach. Other helpful features include debt payoff planning, goal tracking, and detailed reports showing your progress. YNAB also provides outstanding educational resources like free workshops and guides to improve your financial literacy. The bank syncing feature works reliably, though you can also enter transactions manually if preferred.

While YNAB costs more than other budgeting apps, users actually save a lot of money using the app, making the subscription cost worthwhile. This money app is ideal for anyone serious about transforming their financial habits, especially those trying to escape debt or build savings. If you’re willing to invest time learning the system, YNAB delivers unparalleled results in actually changing your financial behavior.

Pros

- Excellent for shared expenses and budgeting

- Clean, straightforward interface

- Flexible split expense tracking

- Detailed spending overview

Cons

- Some advanced features require premium subscription

- Fewer educational resources than some competitors

- Limited investment tracking capabilities

Buddy offers robust collaborative budgeting features that simplify financial sharing with partners or roommates. Its advanced split expense functionality ensures fairness in shared finances by clearly tracking payments and providing options to settle up. This makes it ideal for individuals maintaining separate accounts. The app delivers insightful spending overviews while remaining user-friendly. Its reliable bank connection imports transactions effortlessly, with manual entry available. Although it may lack the depth of analysis found in YNAB or the visual appeal of Copilot, Buddy effectively addresses the unique challenges of collaborative money management.

Pros

- Simple “In My Pocket” spending guideline

- Excellent bill and subscription tracking

- Helpful debt payoff planning tools

- Clean, uncluttered interface

Cons

- Limited customization in free version

- Only connects to US and Canadian institutions

- Some users report occasional syncing issues

PocketGuard is a simple budgeting app with an “In My Pocket” nature that calculates exactly how much you can safely spend after accounting for bills, goals, and necessities. This straightforward approach makes budgeting accessible even to those who find finance intimidating. The app also excels at identifying and helping optimize recurring bills and subscriptions.

PocketGuard features a clean interface that makes financial information easily accessible. The app automatically categorizes transactions and provides spending reports to identify trends. Its bill negotiation tool can help save on recurring expenses, while the debt payoff planner offers clear strategies for achieving financial freedom.

The free version covers essential needs, but advanced features, such as custom categories, require a subscription. PocketGuard is ideal for budgeting beginners without the complexity of detailed financial planning as it prioritizes approachability and actionability. Its optimization tools can save users enough to offset the subscription cost.

Pros

- Straightforward zero-based budgeting approach

- Clean, intuitive interface

- Access to financial coaches with premium version

- Excellent for Dave Ramsey method followers

Cons

- Limited functionality in free version

- Less customizable than some competitors

- Bank syncing only available in premium version

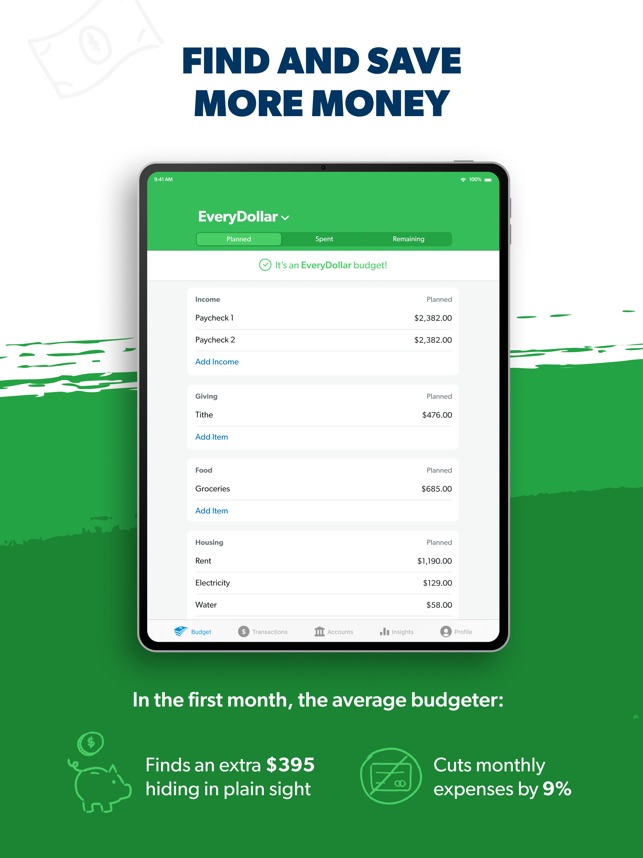

EveryDollar uses Dave Ramsey’s zero-based budgeting method, assigning every dollar a purpose before the month starts. This intentional planning reduces wasteful spending and accelerates financial goals. The app features an intuitive design for quick budget creation. The free version allows manual transaction entry, while the premium version includes automatic bank syncing, custom reporting, and enhanced goal-setting tools.

Users can participate in live Q&A sessions with financial coaches, reinforcing positive financial habits. EveryDollar is ideal for those who value a straightforward budgeting approach that aligns spending with personal and financial objectives. For a no-frills budgeting tool backed by a proven methodology, EveryDollar delivers results.

Pros

- Beautiful, intuitive design that’s enjoyable to use

- Exceptional AI-powered transaction categorization

- No ads or financial product promotions

- Excellent investment tracking capabilities

Cons

- Only works with US financial institutions

- Relatively new with some features still evolving

- Monthly subscription cost ($8.99/month or $69.99/year)

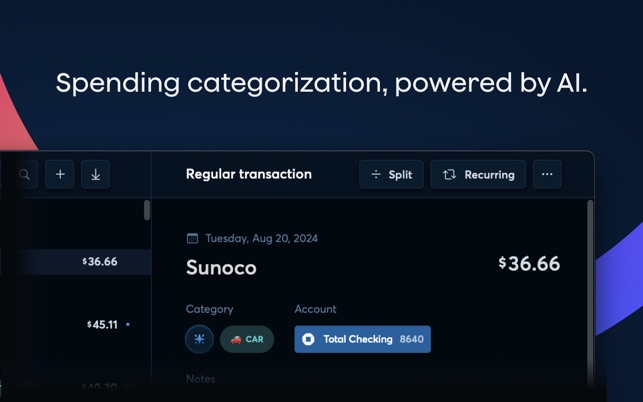

Everything is moving so fast to AI; budgeting apps are not also behind to take advantage of delivering a personalized money management experience with minimal input required. Copilot was an Apple Design Award finalist for its beautiful interface and smart transaction categorization that learns your spending patterns over time. The most helpful feature is automatically categorizing transactions with remarkable accuracy, saving you the tedious work of manual sorting. Its powerful visualization tools help you understand spending patterns across accounts, while the subscription tracker identifies recurring charges you might have forgotten about.

Additionally, investment tracking allows you to benchmark performance against market indexes.

The app is the perfect solution for busy professionals who want powerful financial insights without spending hours categorizing transactions. While it lacks some of YNAB’s behavioral change framework, Copilot excels at giving you a crystal-clear view of your financial picture with minimal effort. The app monetizes through ads or selling financial products. If you value elegant design and time-saving automation, Copilot is worth every penny.

Pros

- Weekly timeframe makes budgeting more manageable

- Beautiful, engaging visual design

- Excellent bill organization and reminders

- Clear “Safe-to-Spend” number for daily decisions

Cons

- Less detailed reporting than some competitors

- Premium features require subscription

- Fewer integration options than larger apps

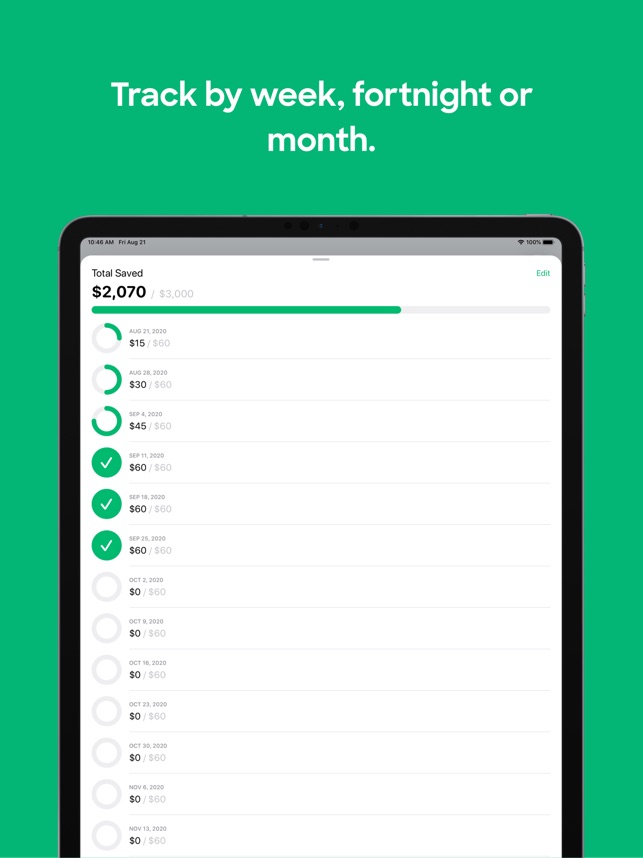

Weekly utilizes a seven-day budgeting cycle for easier, more immediate financial management. This approach helps users avoid the stress of low funds at month-end. The app calculates a weekly “Safe-to-Spend” amount based on bills and savings goals, providing clear direction for daily spending. Its guided setup simplifies budgeting, while the one-tap transaction review system streamlines maintenance. Weekly effectively visualizes upcoming bills and their statuses, ensuring no due dates are missed.

It also offers category spending averages to highlight patterns and improvement areas. While it may lack the detailed analytics of apps like YNAB or Money Manager, Weekly makes budgeting accessible and provides actionable guidance for everyday spending.

Pros

- Backed by Quicken’s established reputation

- Excellent transaction categorization

- Flexible budgeting approach

- Clean, modern interface

Cons

- No free version available

- Fewer customization options than full Quicken

- Some users report occasional syncing issues

Simplifi offers a comprehensive financial overview with minimal setup. The app features a flexible budgeting system that adapts to your spending patterns, avoiding strict category limits. Its modern interface simplifies complex financial information and automatically categorizes transactions, identifying spending patterns efficiently. You get a watchlists for tracking specific categories like subscriptions and a dynamic spending plan that shows safe spending limits. Simplifi also excels in investment tracking and goal setting. The app delivers actionable financial insights with minimal effort. The app also offers solid investment tracking and goal setting capabilities. Simplifi is ideal for users who want a comprehensive financial view without spending hours setting up and maintaining budgets.

Pros

- Visually engaging savings visualization

- Simple, focused user experience

- Customizable saving schedules

- No subscription required

Cons

- Not a comprehensive budgeting solution

- Limited to savings goals only

- No bank account integration

Loot is ultiamte money app for savings goals with a visually engaging 3D money jar interface. Rather than being an all-encompassing budgeting tool, Loot makes saving enjoyable and rewarding. The 3D jar visualization that fills as you progress toward your goal is vrey enjoable. The app offers flexible saving schedules (weekly, bi-weekly, or monthly) and calculates the time needed to reach your target. With 60 customizable jar labels, it adds a personal touch to motivate users. Push notifications help keep you on track, and the payment preview feature shows your saving trajectory.

Loot is ideal for individuals struggling with saving money who need visual encouragement. It complements comprehensive budgeting apps, making it perfect for specific purchases or goals rather than general financial management. If traditional budgeting tools feel overwhelming, Loot’s gamified approach can help you build your savings habit effectively.

iOS Money Apps FAQs

Most apps offer bank connectivity for automatic transaction importing, but many also provide manual entry options. Apps like Goodbudget and Loot are specifically designed to work well without bank connections, making them good choices for privacy-conscious users. However, connecting your accounts typically saves significant time and improves accuracy.

Reputable budgeting apps use bank-level encryption (256-bit SSL) to protect your data. They typically utilize read-only access to your financial accounts, meaning they can’t move money or make changes. Many also offer additional security features like biometric authentication (Face ID/Touch ID) and PIN codes. Always check the security practices of any financial app before connecting your accounts.

YNAB, Buddy, and Goodbudget offer excellent features for couples. YNAB provides comprehensive shared budgeting with strong planning tools, Buddy excels at splitting expenses and settling up, while Goodbudget’s envelope system makes shared spending limits crystal clear. Choose based on whether you fully combine finances (YNAB/Goodbudget) or maintain some separation (Buddy).

Choosing the best money management app depends on your financial goals and preferences. For serious transformation, YNAB offers a proven methodology. If you prefer insights with minimal effort, Copilot’s AI features excel.

Budget beginners can benefit from PocketGuard’s ease or Weekly’s seven-day approach, while detail-oriented users will appreciate Money Manager’s tracking capabilities. For shared expenses, Buddy and Goodbudget simplify collaboration.

Whichever app you select, tracking your money and creating spending plans will enhance your financial control and confidence. Which app do you prefer, and have you found success with any of them? Share your experience!